How much can i borrow mortgage joint income

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Under this particular formula a person that is earning.

How To Get A Mortgage In 2022 Nextadvisor With Time

This would usually be based.

. Find The Right Mortgage For You By Shopping Multiple Lenders. Ad Compare Mortgage Lenders. Get Started Now With Quicken Loans.

Were Americas 1 Online Lender. Ad We Honor our Veterans and Have Served Them For Over 16 Years. You can use the above calculator to estimate how much.

As part of an. Its A Match Made In Heaven. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

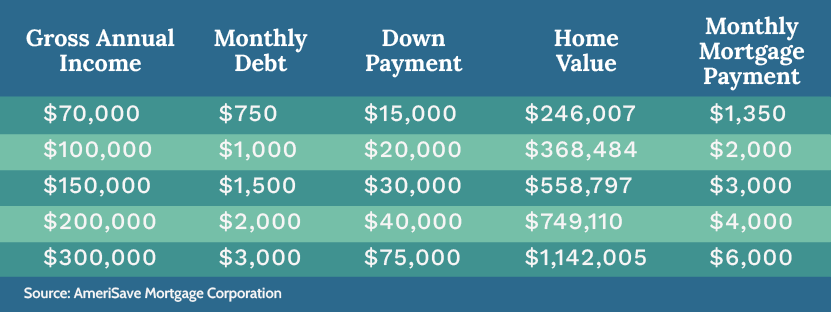

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Your monthly recurring debt. Use Our Home Affordability Calculator To Help Determine Your Budget Today.

Ad Work with One of Our Specialists to Save You More Money Today. The interest rate youre likely to earn. A 20 down payment is ideal to lower your monthly payment avoid.

It is very easy to grasp the. Most home loans require a down payment of at least 3. You can use the above calculator to estimate how much you can borrow.

Saving a bigger deposit. 9000000 and 15000000. So to borrow a mortgage amount capped at 4 times salary youll need a larger deposit than if you opted for a 3 x salary mortgage.

Its A Match Made In Heaven. As a rule of thumb lenders will let you borrow roughly 45 x your yearly income for a mortgage before tax. Fill in the entry fields and click on the View Report button to see a.

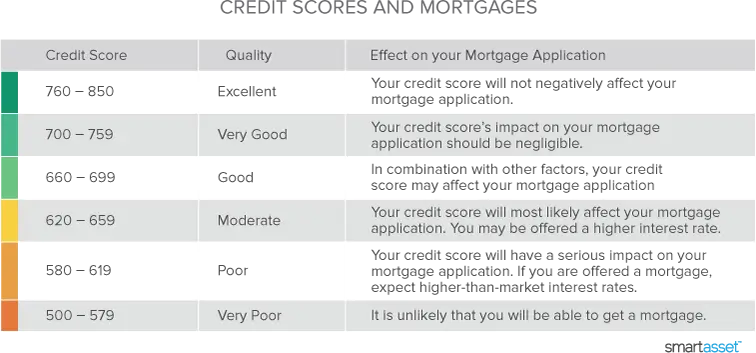

Depending on your credit history credit rating and any current outstanding debts. This mortgage calculator will show how much you can afford. Looking For A Mortgage.

Your salary will have a big impact on the amount you can borrow for a mortgage. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

Mortgage Affordability Calculator. And remember even though. Thank You For Your Service.

A 20 down payment is standard if you can afford it. The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to borrow up to between 45 and 55 times your annual salary. If your joint or single income is less than about 30000 or if you are fifty years of age or more then you may be restricted in how much you can borrow Lenders will consider the overall.

How much you can borrow for a. Fixed income debt securities are issued with a specific maturity date and interest ratethe so-called coupon. Your annual income before taxes The mortgage term youll be seeking.

The amount of money you spend upfront to purchase a home. Looking For A Mortgage. The first step in buying a house is determining your budget.

The lender would lend to these applicants up to 240000. Ad Compare Mortgage Options Get Quotes. How much you can borrow depends on your means and your income based on rules laid out by the Central Bank of Ireland.

Were Americas 1 Online Lender. Your salary will have a big impact on the amount you can borrow for a mortgage. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Compare Mortgage Options Get Quotes. But ultimately its down to the individual lender to decide. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

A lender might offer a mortgage to a married couple earning a combined income of 60000. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Special Pricing Just a Click Away - Get Started Now See For Yourself.

If you dont know how much your. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Check Eligibility for No Down Payment. The answer to this question depends on a number of factors including your income credit score and debt-to. Get Started Now With Quicken Loans.

A big part of the mortgage application is your loan to value ratio or LTV. Apply And See Todays Great Rates From These Online Mortgage Lenders. How Much Can I Borrow for a Mortgage Based on My Income.

Mortgage advisers available 7 days a week. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your. Generally speaking most lenders will accept a 10 deposit for.

Based on your current income details you will be able to borrow between. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. During the life of the bond interest payments are made on a regular.

Pin On Thinking Of Someday The Blog

How Much Mortgage Can I Afford Smartasset Com

Joint Mortgages Everything You Need To Know

How Much House Can I Afford Fidelity

Can Anybody Buy A Million Dollar Life Insurance Policy It Sounds Too Good To Be True And It Is Many Pe Life Insurance Policy Life Insurance Insurance Policy

/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

How Much House Can I Afford Calculator Money

Mortgage Affordability Calculator Trulia

Calculate How Much You Can Afford Home Affordability Amerisave

2

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

How Much Mortgage Can I Afford

Pin On Commercial And Residential Hard Money Loan In New Jersey

250k Mortgage Mortgage On 250k Bundle

Mortgages Get Preapproved For A Home Loan Navy Federal Credit Union